When Will the Housing Market Go Down Again

12 Min Read | Feb 9, 2022

So, you're thinking pretty hard nigh ownership or selling a home in 2022 and want to know how the housing market will look. Well, housing market predictions are well-nigh as reliable as a weather condition forecast—no one can predict what'south going to happen with 100% accurateness. But we can cheque out what existent estate experts are saying and make some guesses virtually the future from in that location.

Remember, a housing market forecast can merely give you an idea of what to expect if you buy or sell a house in the coming months. Never allow it control your housing decisions—simply your personal situation and finances should do that!

With that said, allow'southward take a closer look at what the market is doing.

Housing Market Predictions for 2022

The housing market place exploded similar fireworks last year—and many of those sparks may proceed flying in 2022.

Experts are still seeing a post-pandemic rebound—we're talking steady mortgage rates, job recoveries, and the police of supply and demand all working together to make home sales go kaboom!

Notice expert agents to help you buy your home.

The final four months of 2021 saw dwelling sales rise in September, October and Nov.1 And even though sales dropped a little in December, they were even so up from the year earlier.2 There'due south high demand with depression inventory, and then buyers are still rearing and ready to enter the market.

Here's an overview of what experts predict will happen in the housing marketplace leading into 2022:

| Housing Marketplace Stats | 2022 Annual Predictions | 2023 Annual Predictions |

| Home sales | half dozen.9 million | 7 million |

| Abode prices | Upwards vi.2% | Up 2.five% |

| Mortgage rates (30-twelvemonth fixed) | 3.6% | iii.9%three |

To help y'all put those home prices into dollar signs, the median habitation toll rose to merely over $346,900 last twelvemonth—that's more than than $50,000 higher than in 2020!4 And certain months saw fifty-fifty higher median dwelling toll spikes. For instance, the median home price was $358,000 in Dec, which gear up usa upwardly for more heaven-high prices leading into 2022.5

And let's not forget how interest rates will touch on the overall cost of your dwelling! Final twelvemonth, interest rates were at an all-fourth dimension low—anywhere from 2.15–2.39% for a 15-twelvemonth, stock-still-rate mortgage or 2.74–3.x% for a 30-year, stock-still-rate mortgage.six , 7

But mortgage rates take already started increasing in 2022. Like everything else, mortgage rates are influenced by the economy and inflation. And the Federal Reserve has appear it plans to enhance interest rates this year as part of its efforts to slow inflation.8 While that motility alone won't directly impact mortgage rates, the overall change in the Fed's policies will likely lead to increased interest rates for all borrowers. That stinks because it means new buyers will terminate up paying more than for their house over fourth dimension.

Keep in mind, these numbers will probably change equally the experts crunch new information. But the bottom line is that in 2022, abode sales volition probably stay mostly the same, interest rates will probably go upwardly, and dwelling prices will probable continue to rise (but hopefully at a slower pace).

Okay, at present that we've covered a housing market place forecast at the national level, permit'due south dig deeper into what's happening for buyers and sellers in each state and explore the top questions people have about the housing market forecast in 2022.

Will Heir-apparent Demand for Housing Remain Strong?

Real manor experts say buyer demand volition stay pretty darn strong in 2022. Homes for auction received an average of iii.8 offers to buy in the months leading up to 2022, up from an average of 3.5 offers in late 2020 (not exactly a mind-blowing increase, but hey, it counts).ix

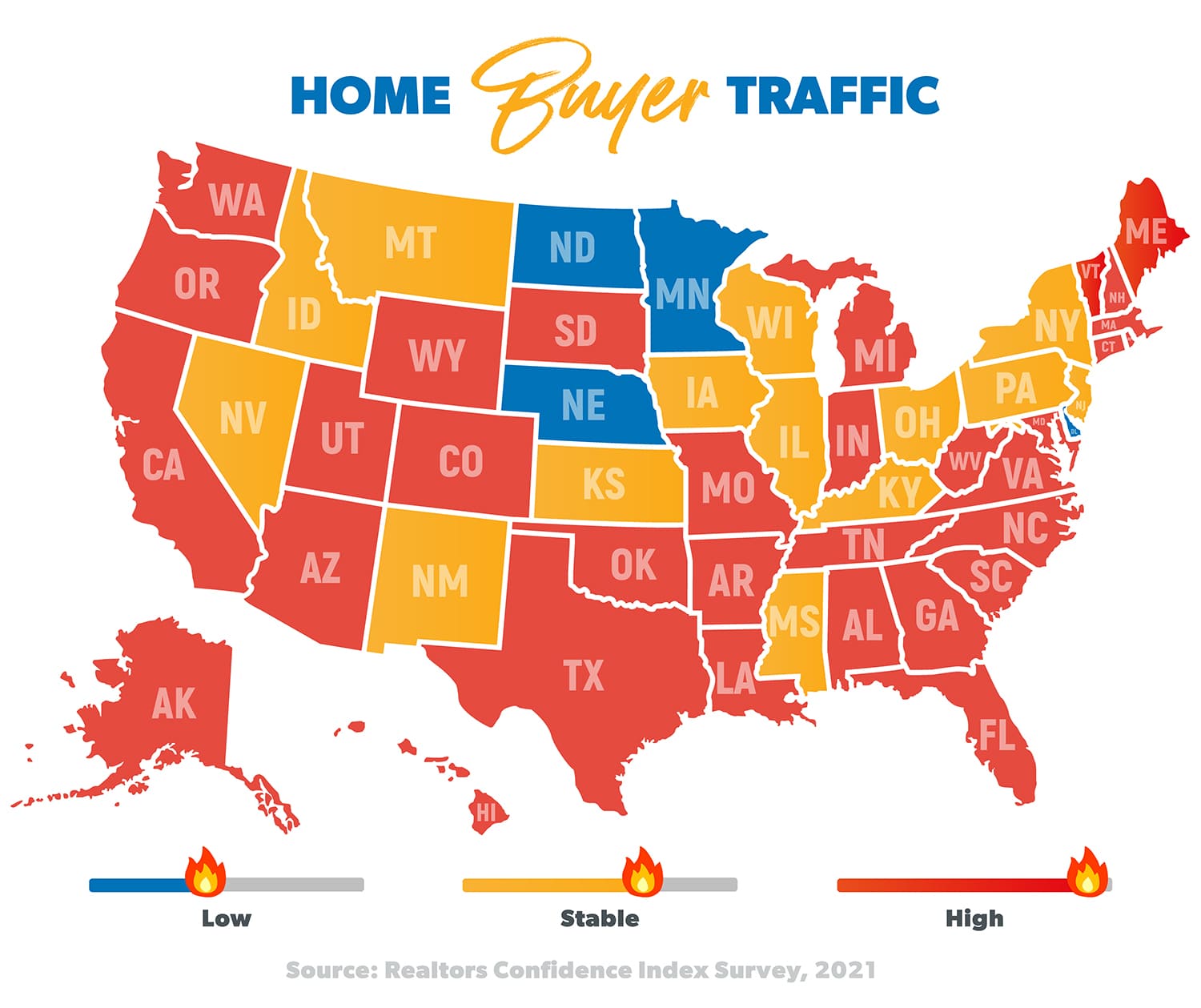

Real estate agents across the country were asked to describe their market based on how many buyers were looking for homes, and they had a lot to say . . . probably because there are a lot of buyers! Check out the map to run into how hot the heir-apparent traffic looks in your cervix of the woods:

All that to say, it looks like buyer traffic (aka need) will remain moderately strong throughout most of the country in 2022, which is a groovy sign for sellers.

Will Housing Inventory Even so Be Low?

Yep, it'due south looking that way! The number of homes actively listed for sale dropped past nearly 180,000 homes at the stop of terminal year, and inventory was down almost 27% compared to the same time frame in 2020.10

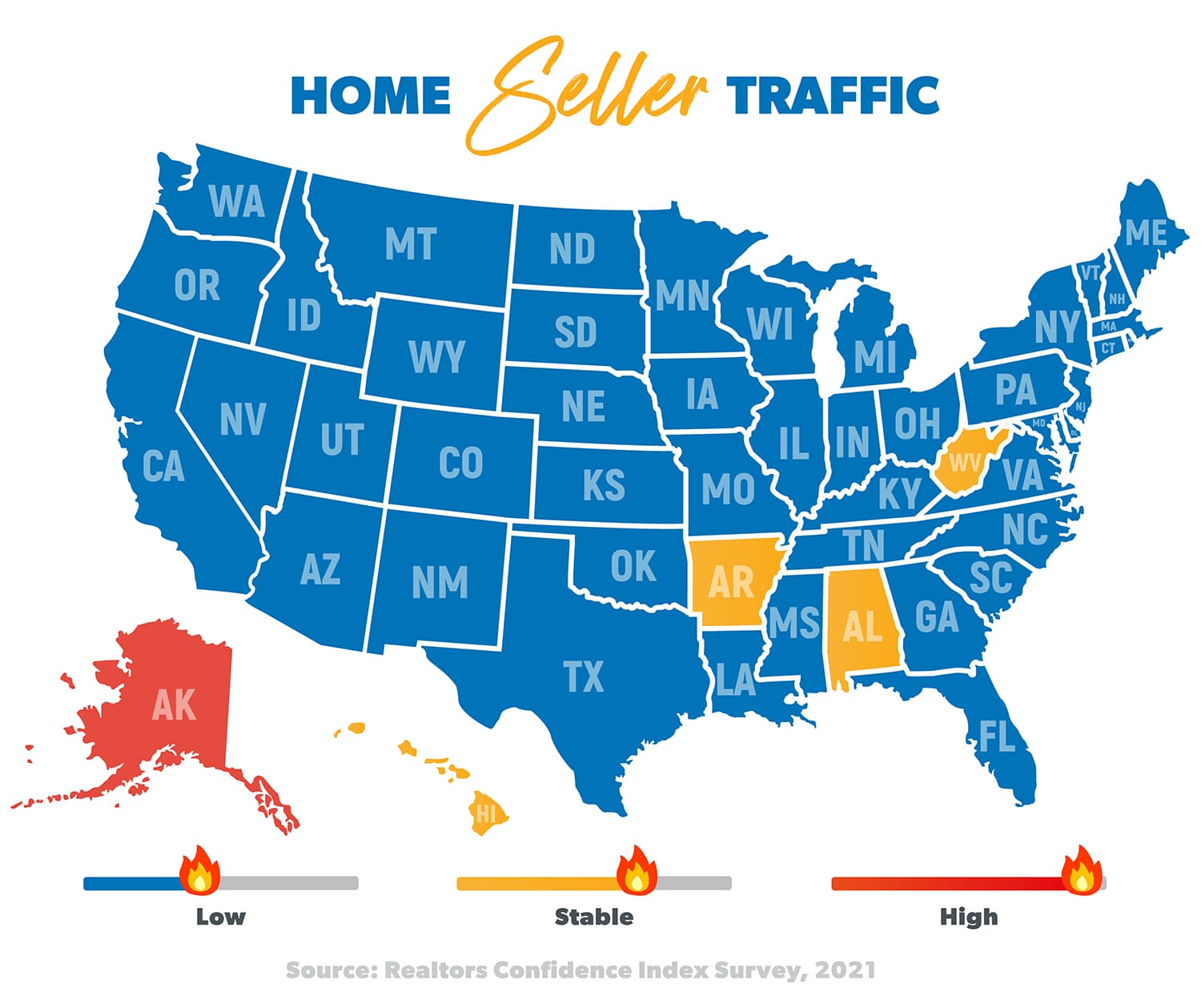

The next map shows that the majority of markets are looking somewhat slow when it comes to seller traffic (aka inventory)—so buyers will have to piece of work harder or look a picayune longer to discover their dream home.

And then, to recap: If y'all live in a land that's blue on this map and y'all're thinking about selling your dwelling, at present's a great time—you'll be one of the few sellers in your market! For buyers, you'll take the most homes to choose from in the orangish and red states.

How Fast Will Homes Fly off the Market in 2022?

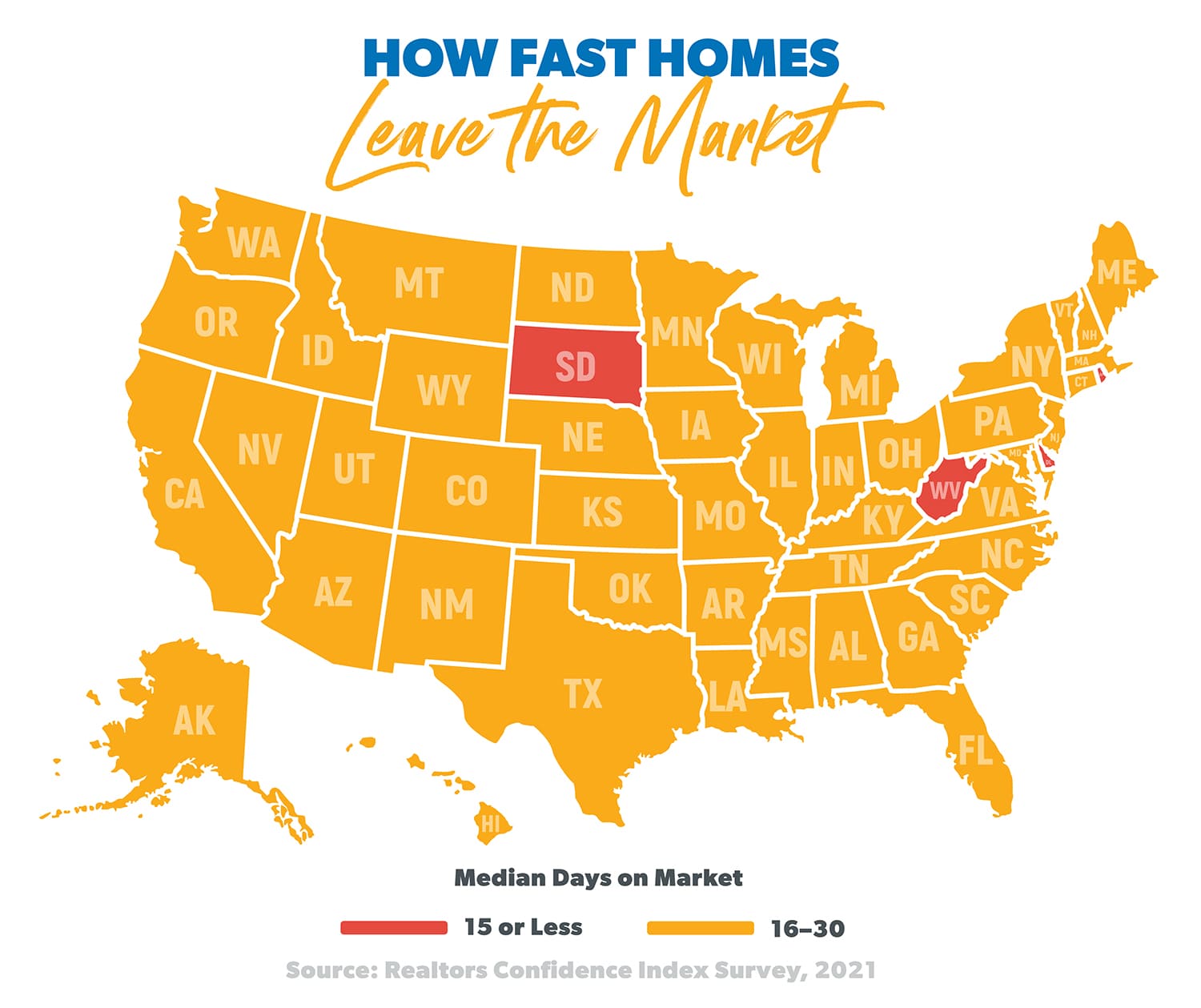

There'due south a good hazard homes will go on to get snatched up fast in 2022. In 2020, most homes stayed on the market for 21 days—and we're now seeing homes go a niggling faster, typically selling after 19 days.eleven

Now, this is great news for sellers who are itching to get their homes sold fast. Simply buyers need to stay focused! You don't want to drag your feet one time y'all find a dwelling that fits your budget and your family because information technology'll likely be gone if you wait too long to commit. That'south why you lot've got to know exactly what to look for in a abode and what you tin can afford earlier you jump in the game.

Of class, every market place is a little different. Hither'south a state-by-state breakup then you tin see about how many days existing homes stayed on the marketplace in your area:

Will There Be a Lot of Foreclosures in 2022?

The nation started seeing a huge jump in foreclosure activity toward the end of terminal twelvemonth, simply the numbers are still much lower than pre-pandemic levels. In fact, foreclosures hit an all-time low, down 30% from the year before.12

But before you become besides excited, hold your horses. Ane huge, glaring reason for that historic depression was the government's temporary ban on foreclosures. Foreclosures weren't happening for most of final year because they couldn't happen.

Foreclosures started rapidly increasing toward the end of last yr, around the time the government lifted the ban. Terminal September, foreclosure filings were upwardly 24% compared to the previous calendar month—and up 102% compared to a year before!13

So, while at that place volition probably continue to be fashion fewer foreclosures than in a normal housing market, it's likely that more foreclosures will happen in 2022 as mortgage lenders work to become back to their version of normal.14

Here'due south what all this foreclosure stuff means for homeowners and buyers:

- Homeowners: With the end of the regime'due south ban on foreclosures, it'll be tough for whatsoever homeowner who lost a stable task and income to go along up with mortgage payments. If that's you, hang in there! There'south more than you tin practise to avoid foreclosure, similar tightening up your monthly budget and finding multiple jobs.

- Home buyers: More than foreclosures hateful you lot might find a sweet discount on a house! Only proceed in mind, buying a foreclosed dwelling could come with its own ready of potential issues. So, make sure you practice your homework on the house and know what y'all're getting yourself into before you buy.

Will the Housing Market Crash in 2022?

It's pretty unlikely that the housing marketplace volition crash in the next few years. Experts say the current marketplace is way different than how it was around 2008–2010—the concluding big housing bubble. Here's why:

- Mortgage providers now have stricter lending rules to assist forbid defaults caused by risky subprime mortgages.

- Housing supply is still super low and probably won't catch upwardly for a few years—so there's little to no danger of home prices dropping like a rock.fifteen

Here'south the bargain: If the number of houses for sale was crazy high and the number of buyers willing to buy them suddenly plummeted, housing prices would get slashed—and that's when a crash would exist something to worry about. But as long as new buyers proceed to enter the market and there aren't enough homes for sale to run into their demand, abode sales and prices will go along going up, and the market should stay healthy.

Will Housing Market Prices Go Downwardly in 2022?

Like we said, it's unlikely that home prices will go down whatever time soon—particularly not in 2022. Some experts think habitation prices volition grow at a slower rate (six%) than nosotros've seen recently.sixteen But others think growth will continue at around the aforementioned pace equally last year (16%).17 And who knows? Prices could abound fifty-fifty faster!

Hither's a look at what home price growth could await like per quarter in 2022, according to Freddie Mac:

| 2022 | Home Price Growth Predictions |

| Q1 | 1.v% |

| Q2 | 1.5% |

| Q3 | 1.v% |

| Q4 | ane.v%eighteen |

Remember, that's on the depression terminate of the growth experts are expecting. If demand keeps increasing and inventory keeps dropping, then people volition be willing to pay even more for housing and prices could grow faster.

On top of that, it's actually difficult to predict home prices. So whatever y'all do, keep saving for a large down payment if you lot want confidence when buying a home.

Is 2022 a Proficient Year to Buy a Home?

The twelvemonth 2022 could be a slap-up year to buy a house—if you're fix. It could likewise be a horrible time to buy if y'all're non. Call up, don't let what's happening with the housing market make your decisions for you lot.

The things that really matter when ownership a house are your personal finances and season of life. No affair what's happening in the market place, y'all're but ready to buy a house if you meet these qualifications:

- You're debt-free.

- You have an emergency fund of three to six months of expenses.

- Your monthly business firm payment will be 25% or less of your monthly accept-domicile pay.

- Yous have a 10–20% down payment.

- You can pay the closing costs up front.

If you don't encounter these qualifications, it doesn't thing if the marketplace is in your favor. Buying a dwelling house right at present would end upward being a curse instead of a blessing. Take your time and get in a improve financial position so you can buy a house the correct way.

What Does All This Mean for Home Buyers in 2022?

Okay, it looks like you lot'll nevertheless need to bring your A game if y'all want to buy the home of your dreams in this market. With more buyers than sellers, you'll probably be up against some heavy competition, loftier housing market prices, and possibly even a behest war.

Some other downside: Signs are showing that the low inventory issue is going to hang around for a while. Domicile inventory did increase a footling concluding autumn—rise to a nearly vii-calendar month supply—but information technology didn't stay that manner.19 At the tail end of the year, inventory tanked to just a i.viii-calendar month supply.20

And while homebuilders are confident they'll do plenty of business organisation in 2022, that doesn't mean ownership a newly built business firm will be easy for you.21 Rise prices, supply shortages and even authorities tariffs are all making it crazy hard for homebuilders to actually build enough houses to proceed up with need.22 , 23

Translation: The pickings may be slim when information technology comes to ownership a business firm. That means yous may have to surrender some of your wants to get a house that has everything you demand.

But don't worry—there's a bright side for buyers too.

If you're getting a mortgage, interest rates are still looking as expert every bit a blue snow cone on a hot summer day—for now. But like we said at the beginning, they're slowly inching up and will likely keep increasing in 2022 (thanks a lot, Federal Reserve).

Still, you'll probably have a good gamble of locking in a lower-than-average mortgage rate. And for the tape, lower rates are a good thing because they mean a lower monthly payment and less of your money going toward involvement over the life of the loan. Woo-hoo!

What Does All This Hateful for Home Sellers in 2022?

Sellers out in that location tin feel pretty good nearly selling their homes in 2022. If that's you, you might want to put your business firm on the market place sooner rather than subsequently—while inventory is yet low. (But over again, simply practise that if you're truly set to sell your business firm. Don't allow the market exist the deciding factor!)

If you do make up one's mind to sell, you may have a trivial more competition in 2022 due to foreclosures picking up again and habitation prices rising. But the good news is that there are notwithstanding plenty of buyers out there.

If yous work with an experienced agent, you'll be able to capitalize on dwelling house prices, navigate multiple offers, and find the correct heir-apparent. With an expert by your side, it'll be fifty-fifty easier to sell your business firm at a great toll this year.

How to Buy or Sell With Confidence in Whatever Housing Marketplace

The housing market isn't known for existence easy to predict. That'southward why it pays to have a trusted professional in your corner.

Whether yous're buying or selling, yous need an agent who has weathered the storms of real manor. And you can find them through our Endorsed Local Providers (ELP) plan. ELPs have earned our seal of approval equally RamseyTrusted pros. We only recommend elevation-notch agents who help yous shell your housing goals—no matter what the market is doing.

Discover a RamseyTrusted agent!

About the author

Ramsey Solutions

cummingshaile1973.blogspot.com

Source: https://www.ramseysolutions.com/real-estate/housing-market-forecast

0 Response to "When Will the Housing Market Go Down Again"

Post a Comment